Centralization makes management, repair, and upkeep duties much simpler and efficient. Management for a multi-family property is substantially easier than managing similarly-sized/cash-flow generating single-family home investments. Laundry rooms, moving supply sales, cell phone tower rentals, and ATM are other common examples of ways that landlords monetize their properties aside from rent- although there are many other potential opportunities. Additional sources of income include exclusivity deals with cable and phone providers, who then provide compensation to owners. The availability of ancillary income sources can dramatically and directly impact the value of a property, which will be reflected in its cap rate. You can generate cash flow from multi-family buildings from more than just tenant rents. As homeownership trends downward, people still need a place to live- and they are increasingly choosing to live in multi-family apartment buildings. This is not an ideal situation for several reasons, but it does provide investors with a phenomenal opportunity to benefit from these macro trends. We find ourselves in a situation where, unfortunately, homeownership is out of reach for more and more Americans.

This fact should come as no surprise to anyone who has followed the rocketship trajectory of the housing market in the past decade or so. $200,000 gross rent income – $4,000 – $40,000 – $6,000 = distributable cash flow of $150,000.Īccording to the Pew Research Center, more people are renting now than at any time in the last 50 years. Keep in mind that these are illustrative numbers, and every situation is different, but the calculation will look something like this: We can put that number at around $6,000 a month. Finally, you will have ongoing expenses like repairs and management fees. You will also be liable for taxes and insurance, and potentially a mortgage payment, let’s say $40,000 per month. Let’s assume you have 2 vacant units, which reduces your total income by $4,000.

That gives us a gross rent income of $200,000.

For instance, imagine a multi-family apartment building with 100 units, with each unit renting for $2,000 per month.

#FAMILY CASHFLOW HOW TO#

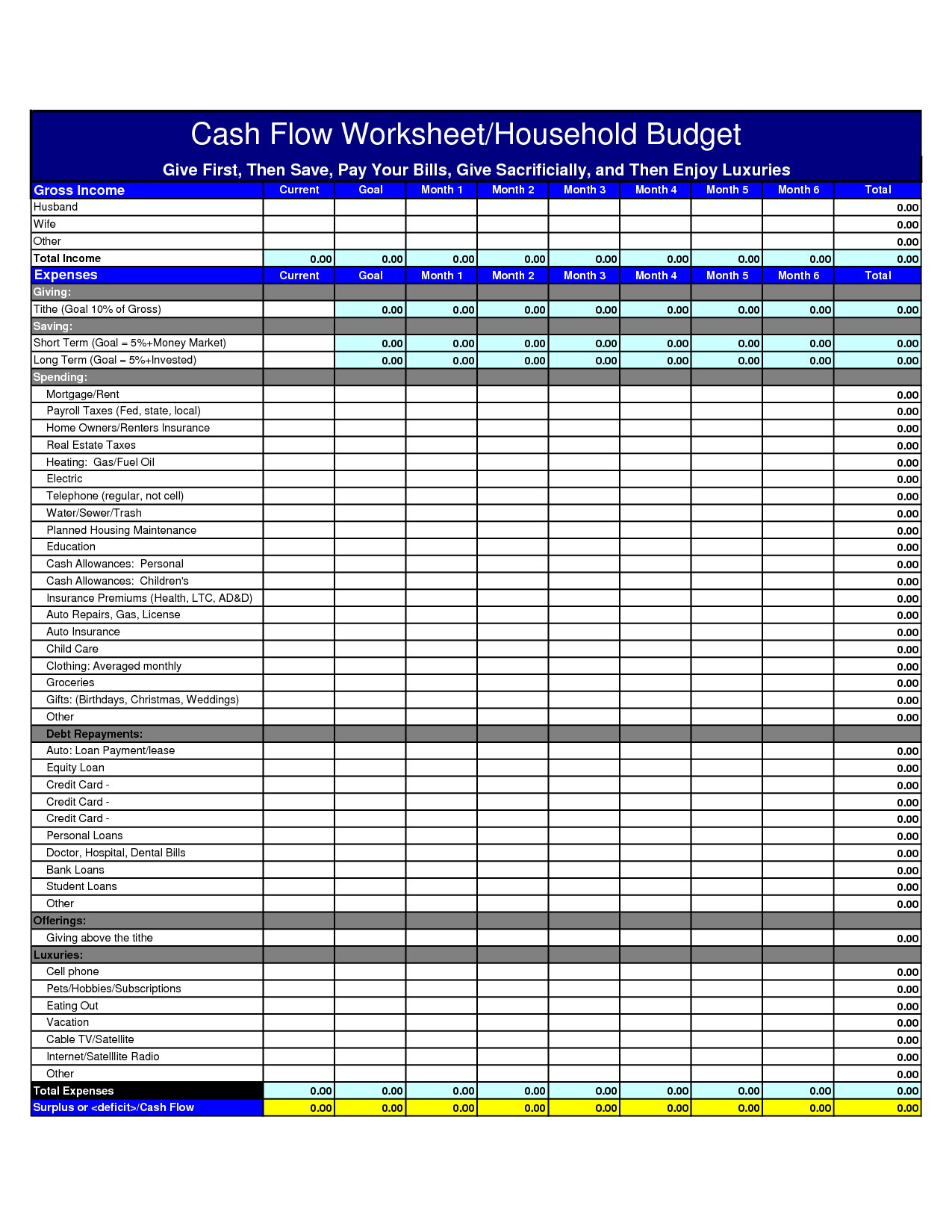

How to calculate cash flowĬalculating cash flow is a relatively straightforward process. When you own a share of these companies, and others like them, you are entitled to a quarterly, semi-annual, annual, or irregular (not on a set schedule) dividend payment.Ĭash flow real estate investing operates on a similar principle- investors deploy capital in a real estate asset and then receive regular payments from the profit generated by their investment, whether that be ongoing retail leases or cash flow from multi-family apartment building tenants. The simplest way to describe cash flow investing is to compare it to the dividends paid by stocks like Johnson and Johnson ( JNJ) or Coca-Cola ( KO). But how exactly does multi-family cash flow real estate work, and is it a safe investment compared to other common assets like stocks, bonds, and other forms of real estate? What is cash flow inv esting? Investment assets that generate steady income are desirable to many investors, large and small, particularly those that are easing into retirement. If you’ve been taking the time to research the pros and cons of multi-family real estate, one benefit you’ve likely read about is regular cash flow.

0 kommentar(er)

0 kommentar(er)